Dedge 101

April 08, 2020

Have questions? Find us on Twitter and Discord and Defi Crypto

After Dedge’s initial launch, one of the most frequent questions we have been asked is what exactly is Dedge, and what can it do. The goal of this blogpost is to clarify what Dedge can do, and how to get started using it.

The short version is that you can think of Dedge as Compound++, it allows you to do everything on Compound, but also switch between coins instantly!

What is Dedge?

Dedge is an extension on the Compound Protocol. With Dedge, you can manage your positions, and hedge against market fluctuations. It achieves this by giving you the ability to swap your collateral AND debt positions on Compound instantly.

Think back to Black Thursday when the price of ETH was crashing. You’re heavily leveraged on ETH, with DAI as your borrowed (debt) asset on MakerDAO or Compound. You have to quickly repay your debts, or you will be liquidated.

If you were using Dedge, that wouldn’t be a problem at all: you just convert your borrowed (debt) asset from DAI to ETH, and now the debt you owe is also dropping.

But you can go one step further and convert your ETH collateral into DAI collateral, essentially “freezing” the value of your supplied collateral. Meanwhile your borrowed amount (debt) is crashing - thanks to the crash, your position is actually profiting from the crash.

Is Dedge on MakerDAO or Compound?

Dedge lives on top of Compound, it doesn’t interface with MakerDAO except to import positions from it.

Why is there an Import Maker Vault button?

The Import Maker Vault button is a convenience feature for users to easily convert their MakerDAO vault positions into Compound positions. You can also directly supply collateral into Compound through Dedge.

Quickstart

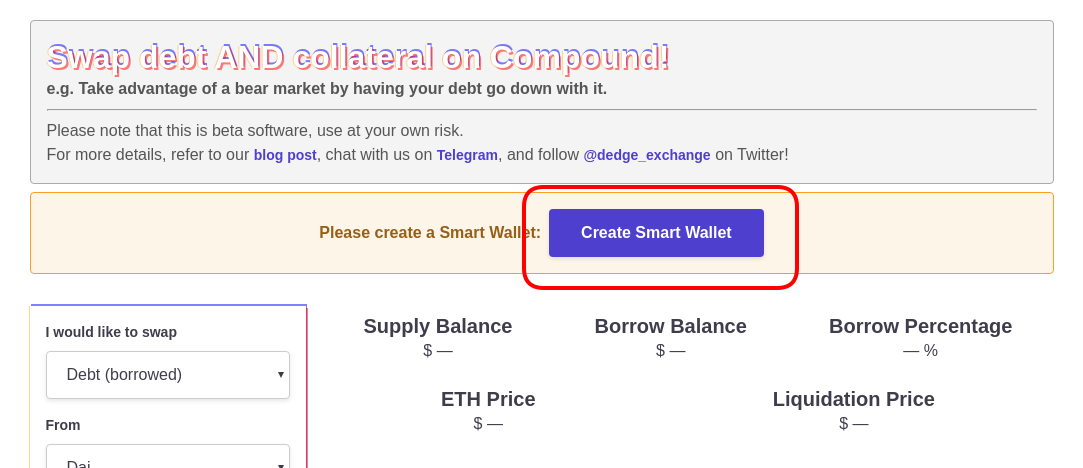

1. Create A Smart Wallet

You’ll need to first create a “Smart Wallet”, which is a non-custodial smart contract that you control. The Smart Wallet is needed as it allows Dedge to perform a series of atomic transactions on your behalf. For example, taking out and repaying a loan.

Once you’ve done that, you should be greeted with a page simliar to:

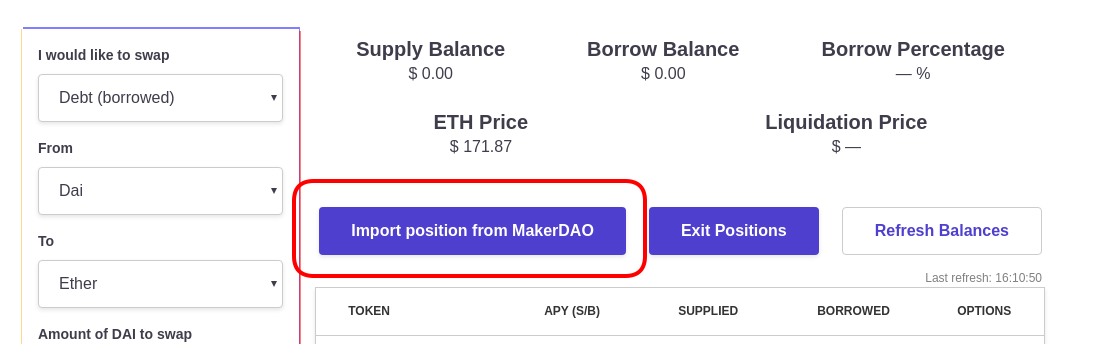

1.a (Optional) Migrate MakerDAO Vault

If you have a MakerDAO vault, you can “migrate” your MakerDAO Vault positions into Dedge. Do note that this is not required, you can simply supply collateral as in Step 2.

Unfortunately due to how Compound operates, we cannot migrate your existing Compound positions.

2. Supply Collateral

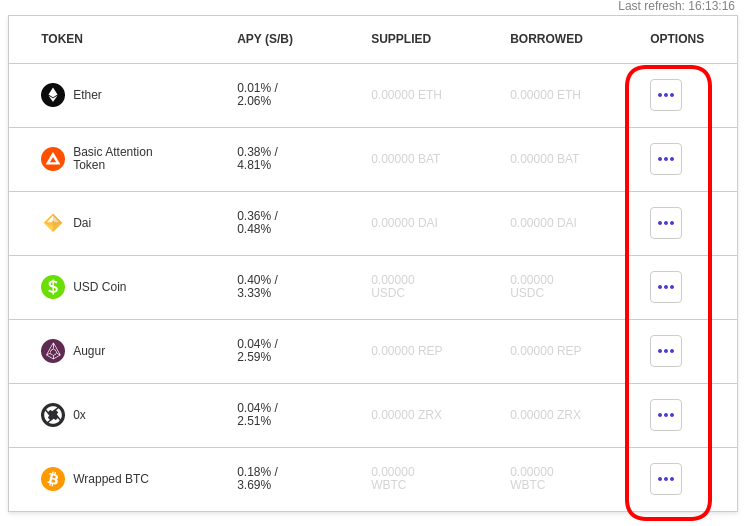

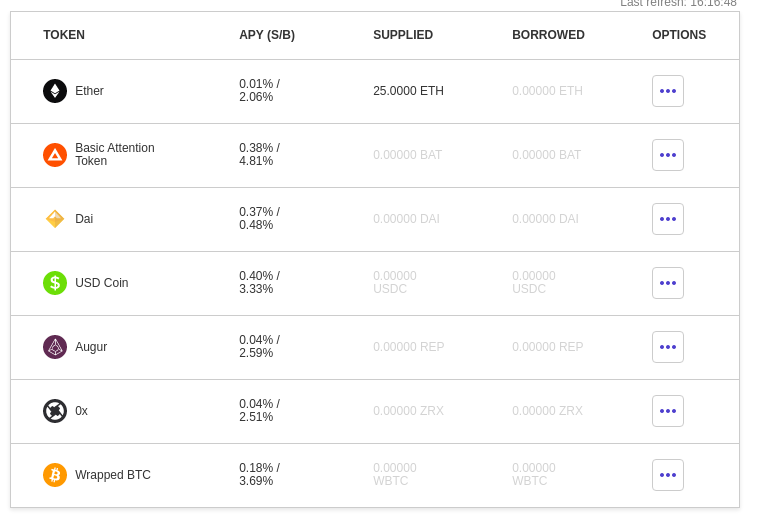

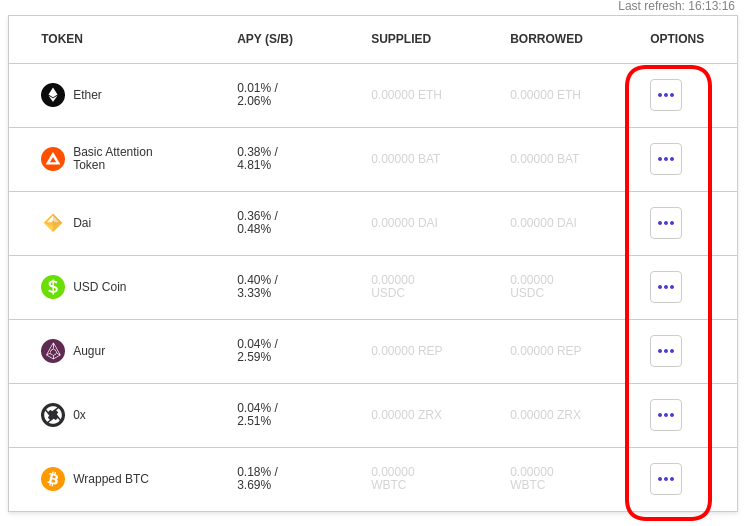

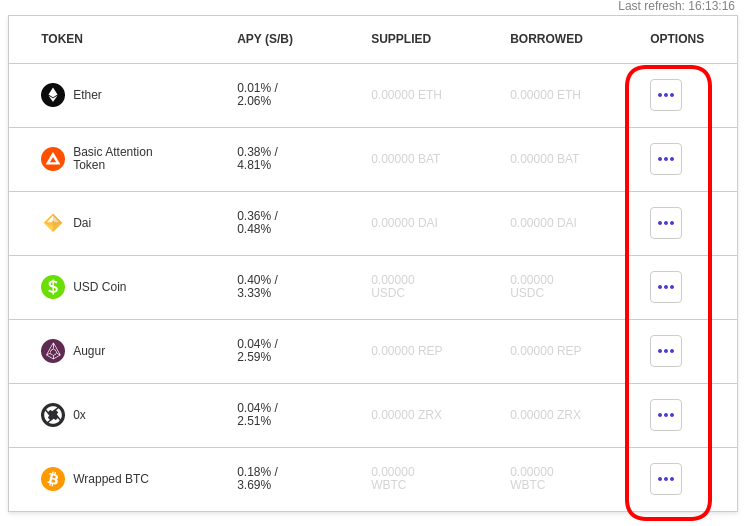

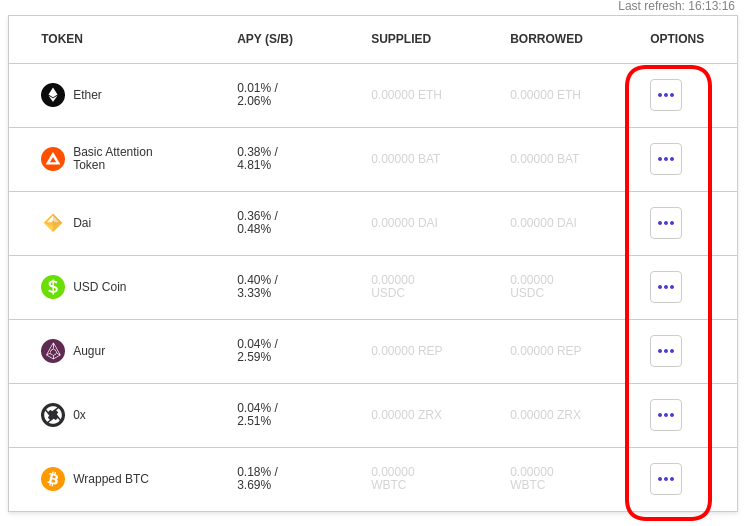

Once you’ve setup your smart wallet, you can start using it just like how you use Compound. If you didn’t import a MakerDAO Vault, you’ll need to supply some collateral before you can do anything on Dedge. Click on the “options” column for the asset you would like to supply:

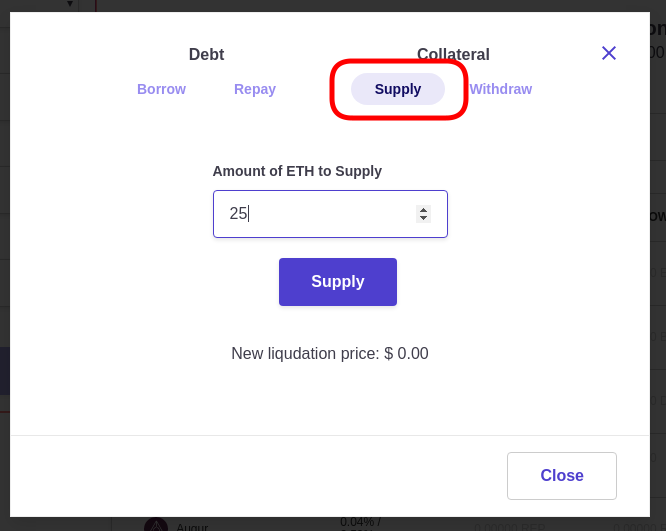

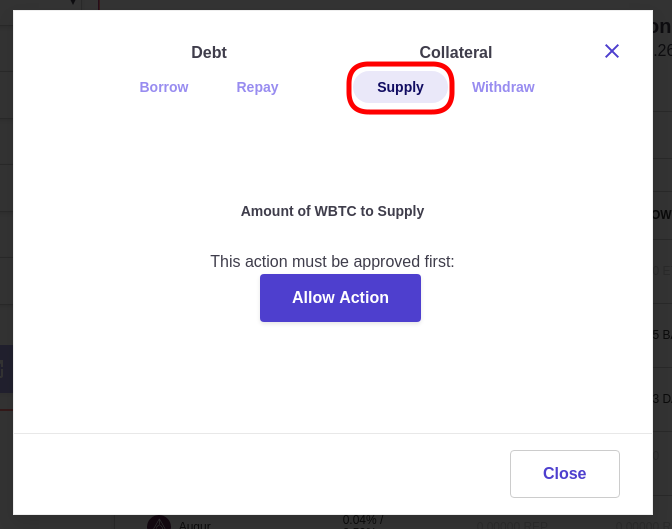

Click the “Supply” tab under “Collateral”:

(Note that for ERC-20 tokens, you’ll first need to “Allow Action”):

Enter the amount you would like to supply and click on the Supply button.

Once the transaction has been mined (this might take anywhere between 1 - 10 minutes), your balances should reflect your new position:

3. Borrow Asset

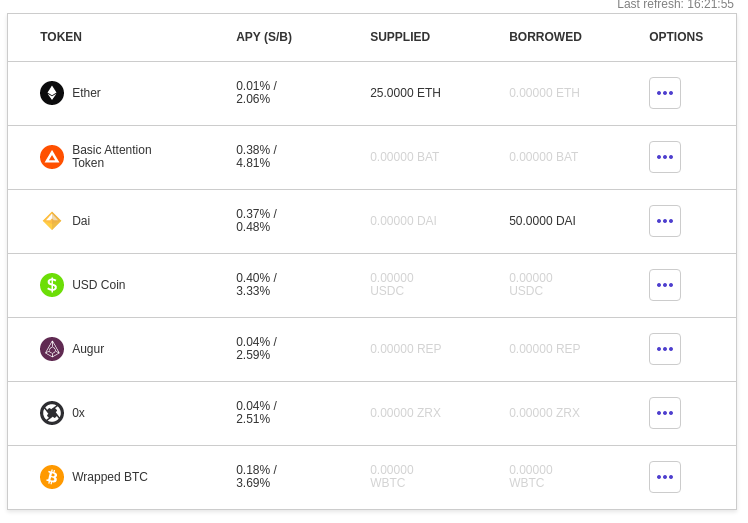

Once you’ve supplied a collateral, you can now borrow an asset. For this example, I’ve chosen to borrow DAI, but you can borrow any asset you please!

Just like supplying collateral, click on the “options” column for the asset you would like to borrow:

Click the “Borrow” tab under “Debt”:

Enter the amount you would like to borrow and click on the Borrow button.

Once the transaction has been mined (this might take anywhere between 1 - 10 minutes), your balances should reflect your new position:

4. Swapping Debt (Borrowed Asset)

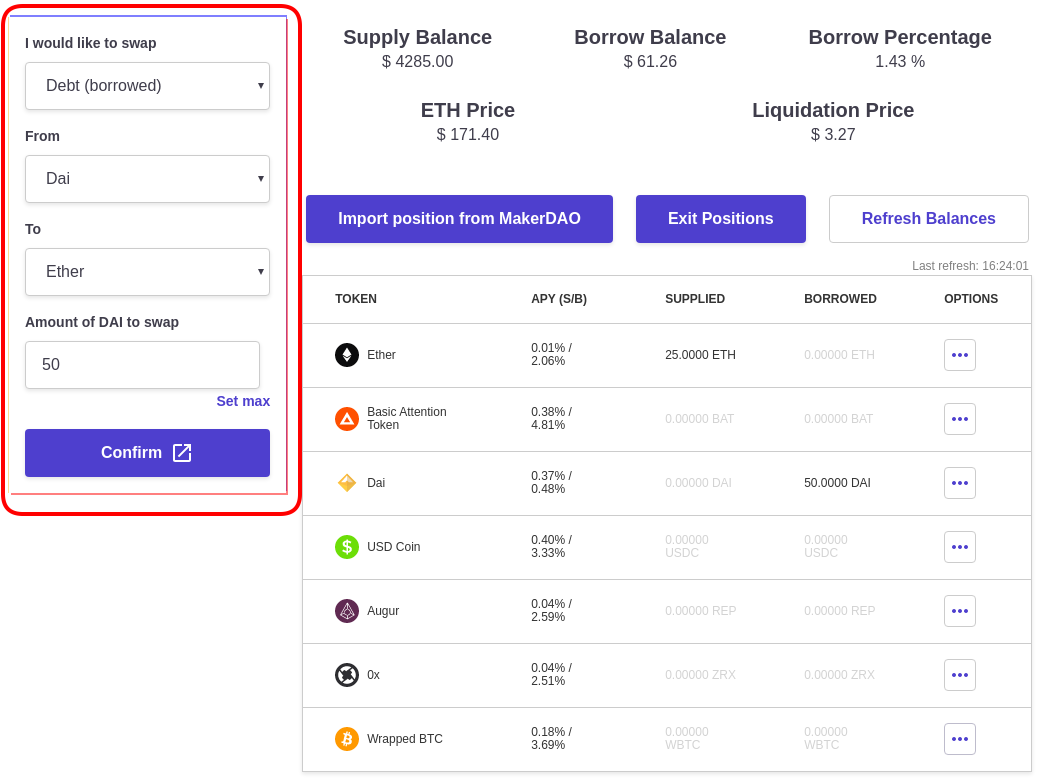

Say the price of ETH is crashing, you want to swap your debt of 50 DAI to ETH to prevent your account from getting liquidated (your debt falls with your collateral). Enter your details in the left panel like so:

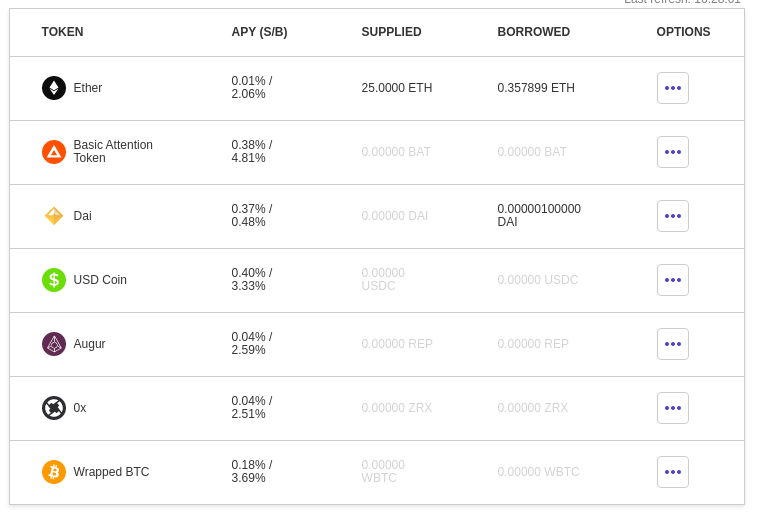

Click confirm, wait for your transaction to be mined (this might take anywhere between 1 - 10 minutes), and your balance should reflect your new position:

5. Swapping Collateral (Supplied Asset)

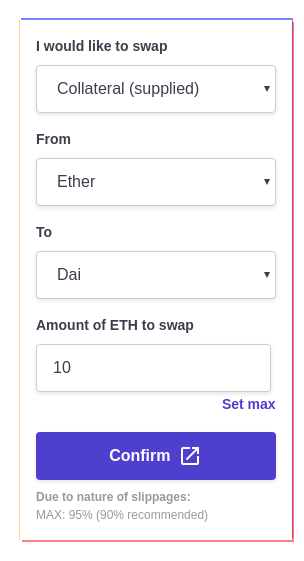

Say you would like to convert 10 ETH of your collateral into BAT, since it has a better APY%, but you’ve borrowed so much that you can’t withdraw 10 ETH safely. No problem, simply change your details in the left panel to:

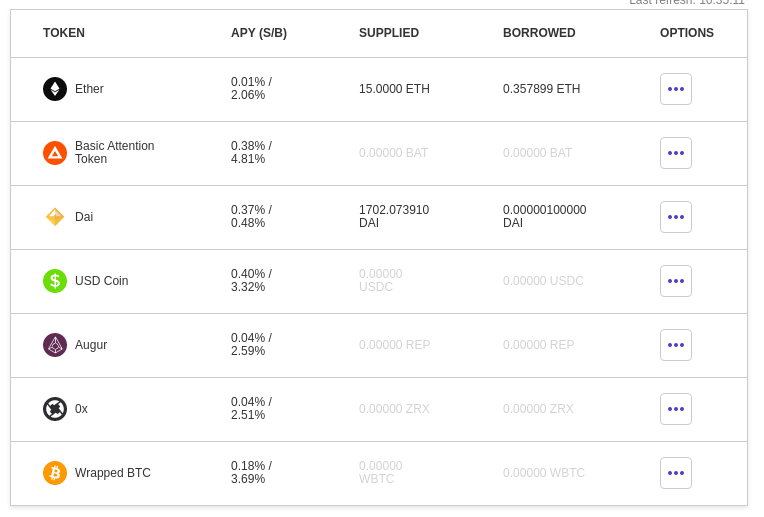

Click confirm, wait for your transaction to be mined (this might take anywhere between 1 - 10 minutes), and your balance should reflect your new position:

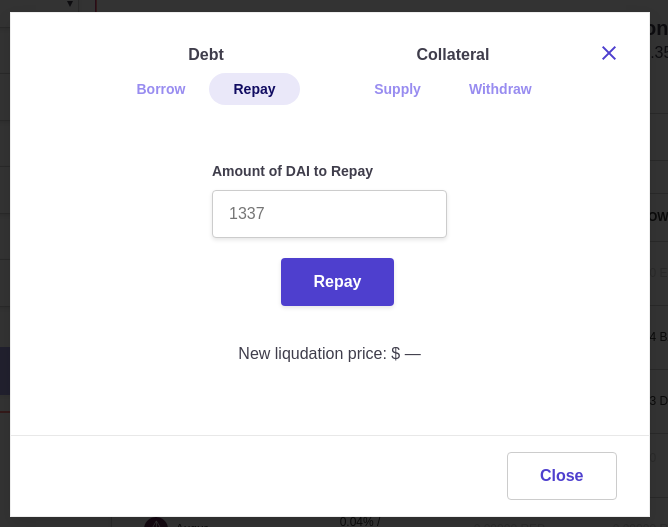

6. Repaying Debt

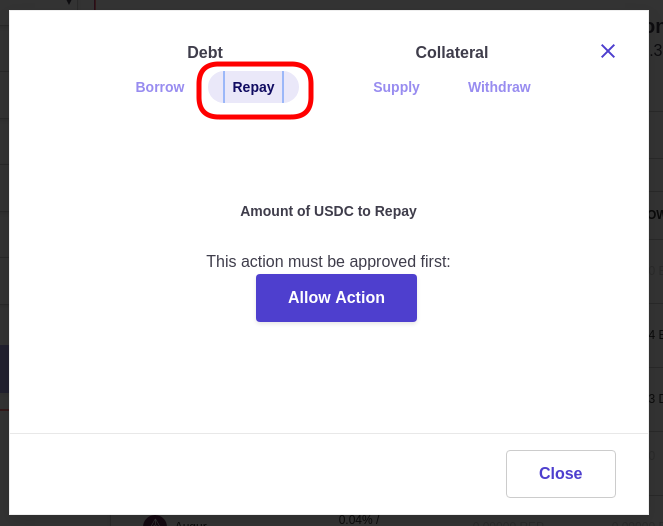

To repay debt, you can simply click on the “options” column for the asset you would like to perform the action on:

Select the “Repay” tab, and click approve (you’ll need to do this once for each ERC-20 token).

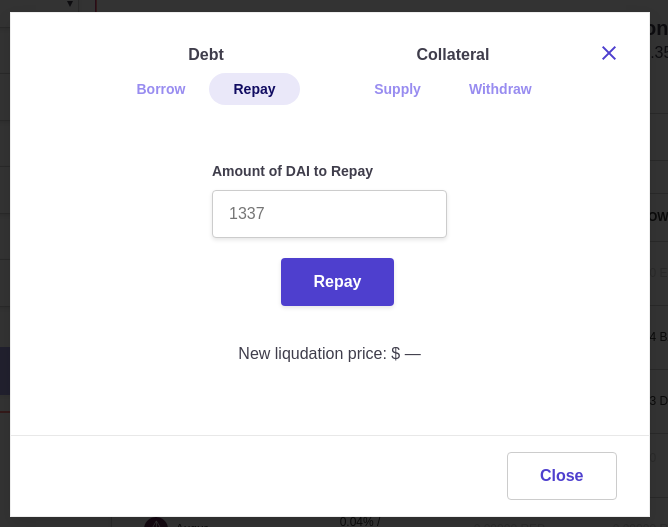

Once the ERC-20 tokens have been approved, you can start repaying your debt:

7. Withdrawing Collateral

To repay debt, you can simply click on the “options” column for the asset you would like to perform the action on:

Select the “Withdraw” tab, enter the amount you would like to withdraw and click on the Withdraw button.

Questions

If you have any questions contact us on telegram.

Similar interests

- Non-gamstop Casinos

- UK Non Gamstop Casinos

- Non Gamstop Casinos

- 온라인 홀덤사이트

- Migliori Siti Di Poker Online

- UK Online Casinos Not On Gamstop

- Casinos Not On Gamstop

- UK Gambling Sites Not On Gamstop

- Meilleur Casino En Ligne France

- Casino En Ligne

- Non Gamstop Casinos Uk

- Sites Not On Gamstop

- Casino Not On Gamstop

- Non Gamstop Casino

- Non Gamstop Casino Sites UK

- Gambling Not On Gamstop

- UK Casinos Not On Gamstop

- Non Gamstop Casinos UK

- Non Gamstop Casino UK

- Casino Sites Not On Gamstop

- Slots Not On Gamstop

- UK Casinos Not On Gamstop

- UK Casino Not On Gamstop

- Gambling Sites Not On Gamstop

- Non Gamstop Casinos UK

- Casino Crypto Liste

- Casino Crypto Liste

- Casino Non Aams

- Site De Paris Sportif Belgique

- Meilleur Casino En Ligne Belgique

- Casino En Ligne

- 코인카지노

- 파워볼사이트 에스뱅크

- Casino En Ligne

- Lista Casino Online Non Aams 2026

- Casino Senza Richiesta Documenti

- Bonus Casino Senza Invio Documenti

- Site De Casino En Ligne

- Casino En Ligne Argent Réel France

- Meilleurs Casino Crypto